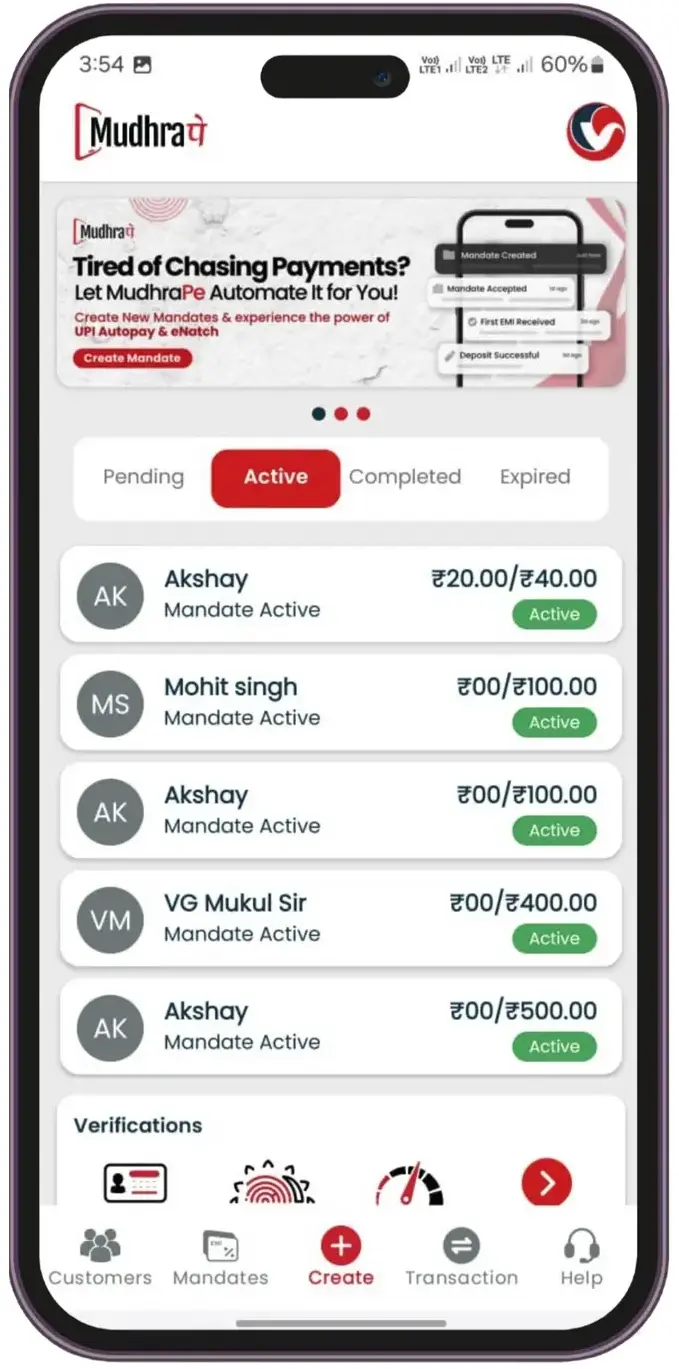

Create New Mandates & experience the power of UPI Autopay & eNatch

MudhraPe automates the entire credit collection process, allowing you to collect payments from your clients, relatives, or friends in a few easy steps. Forget the headaches of multiple reminders or delayed payments

Know your client with our seamless KYC verification services. MudhraPe integrates with PAN, Aadhar, Voter ID, and CIBIL Score APIs to verify the identities of your clients before proceeding with transactions.

With MudhraPe, you can collect payments automatically using eNACH and UPI AutoPay. These options enable your clients to authorize recurring payments easily, eliminating the need for manual transfers.

Stay informed with real-time payment updates. MudhraPe provides you with live tracking of your credit collection process, allowing you to monitor every transaction from initiation to completion.

Creating a mandate is as simple as entering your client’s phone number. MudhraPe generates secure mandates in minutes, allowing for swift approval and processing. This ensures that you have a steady stream of payments without any delays or complications.

MudhraPe is designed for businesses, professionals, and individual lenders who manage multiple clients. Our intuitive dashboard allows you to track, manage, and collect payments from multiple clients simultaneously.

Keep your clients on track with automatic payment reminders. MudhraPe sends reminders before and after due dates to ensure that clients never miss a payment, helping you avoid the awkwardness of manual follow-ups.

We prioritize your security. With robust encryption protocols and industry-standard security measures, all transactions on MudhraPe are safe and transparent. Our platform ensures data privacy, compliance with legal regulations.

We harness the power of cutting-edge technology to deliver seamless, secure, and efficient ENACH/ECS services. Our state-of-the-art infrastructure ensures high availability, reliability, and scalability, enabling you to process transactions with confidence and speed.

Creating a mandate is as simple as entering your client’s phone number.

Getting started with MudhraPe is simple. Create an account, complete your KYC verification, and you’re ready to begin.

Getting started with MudhraPe is simple. Create an account, complete your KYC verification, and you’re ready to begin.

Getting started with MudhraPe is simple. Create an account, complete your KYC verification, and you’re ready to begin.

Running a business comes with its fair share of challenges—credit collection shouldn’t be one of them. MudhraPe helps businesses manage client credit with automated reminders and secure payment options.

Whether you're a consultant, lawyer, or freelancer, collecting credit from clients can be time-consuming. MudhraPe simplifies the process, giving you more time to focus on your work

If you've lent money to a friend or family member and need help collecting it, MudhraPe is here to assist. Our platform automates the collection process while maintaining the personal touch needed for these transactions.